AI-Powered Personal Finance Management App

At CodeTheorem, we recognized a critical need: managing personal and household finances remains fragmented, manual, and often overwhelming. We developed an independent AI-powered Personal Finance Management (PFM) application designed to unify, automate, and personalize financial oversight for individuals and families.

Problem Statement

Fragmented Financial Overview

Users struggle to get a unified, real-time view of their finances across multiple banks, wallets, and family members—leading to confusion and disjointed financial planning.

Manual Tracking & Missed Anomalies

The need to manually categorize expenses and interpret statements results in fatigue, overlooked errors, and inefficient financial decisions.

Unintelligent Payment Management

Duplicate or accidental transfers—especially among individuals or family members—go unchecked due to a lack of smart reminders or validations.

Hidden Costs from Subscriptions & Loans

Unmonitored subscriptions and unclear loan terms silently drain funds, with salary anomalies and interest surprises often going unnoticed.

Low Financial Engagement & Awareness

Traditional tools fail to simplify financial data, leaving users—especially families—disengaged and unaware of spending habits, savings, and goals.

AI Tools & Technology Stack

Advanced tech & tools behind our AI-Powered Travel Applications

Figma

Angular

React

Chat GPT

IOS

Android

RAG

Figma

Angular

React

Chat GPT

IOS

Android

RAG

AI-Powered Solution

CodeTheorem built a multi-layered AI solution tailored to modern, everyday financial needs for both individuals and families.

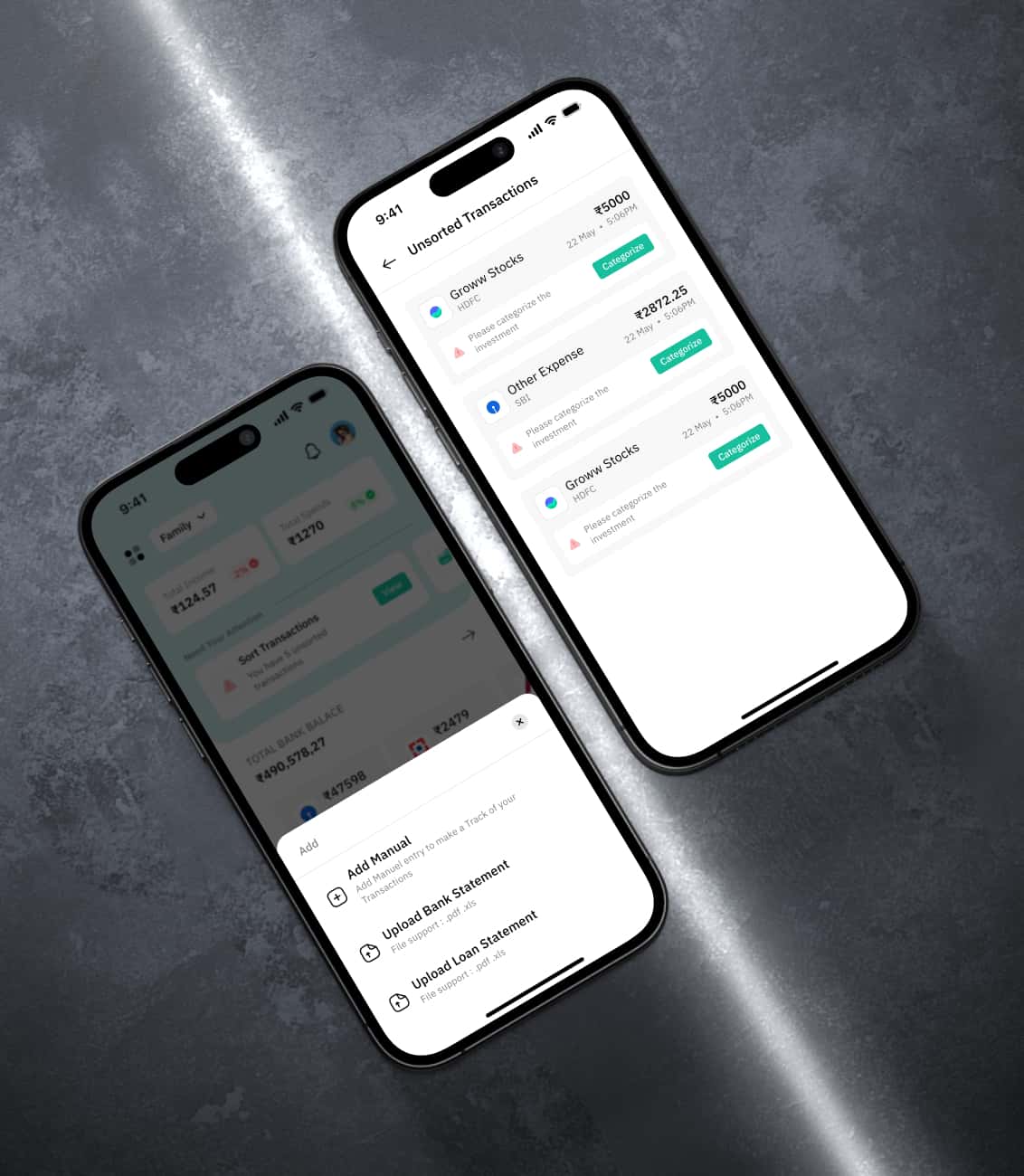

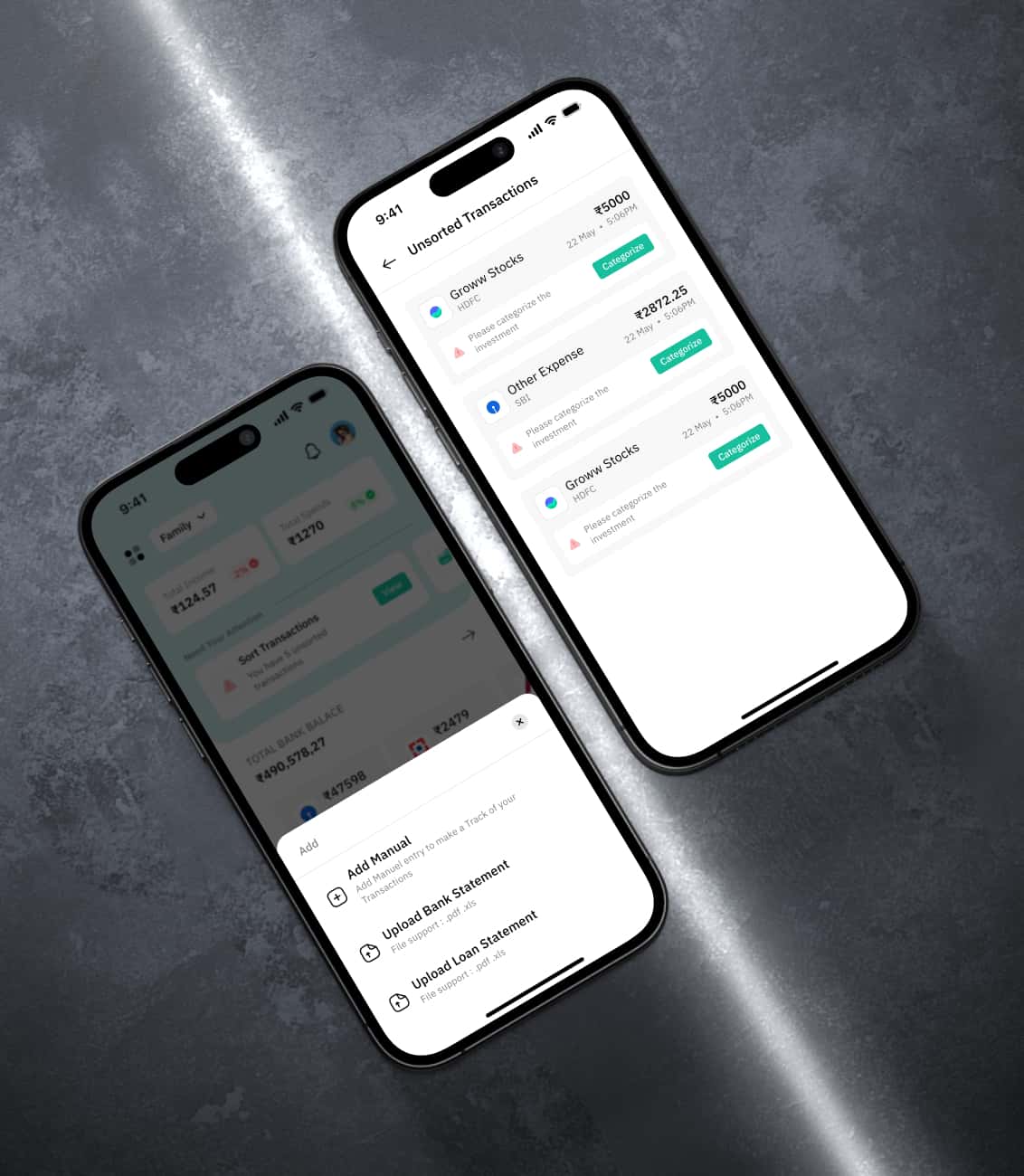

Flexible Data Integration

Real-time syncing with bank accounts and wallets, PDF statement upload with OCR + NLP, email parsing for digital receipts and salary slips, and Account Aggregator integration for regulated financial data access.

Smart Categorization Engine

Auto-tags recurring expenses (rent, groceries, tuition), learns from corrections, adapts to user behavior, and differentiates personal vs. shared family expenses.

Contextual Alerts & Notifications

Flags duplicate/missed payments, unusual activity or overlapping payments, subscription charges on inactive services, EMI interest rate changes or unclear terms, and irregular salary deposits.

Intelligent Personalization

Offers a voice assistant for financial Q&A, peer spending comparisons, personalized tips and reminders, and family dashboards with member-wise budgeting and goal tracking.

Specialized Features

Includes duplicate transfer detection, loan interest monitoring, salary anomaly alerts, and centralized subscription tracking.

Outcomes

Reduced Financial Errors

Achieved fewer missed or duplicate payments and early detection of salary or loan anomalies.

Enhanced Visibility

Provided a unified view of all personal and household financial activity.

Informed Decision-Making

Timely alerts enabled better financial planning and faster responses.

Improved User Experience

Delivered a simple, jargon-free interface and easier family coordination with shared dashboards and financial tracking.